A new year rally on the first weekend of 2021 accelerated on Sunday as top cryptoassets keep grinding higher, with bitcoin (BTC) jumping above USD 34,000 and ethereum (ETH) surpassing USD 1000 for the first time since February 2018.

At the time of writing, BTC trades at USD 33,315, correcting from USD 34,566, reached earlier today. The price is still up by almost 3% in a day and 24% in a week. Also, it rallied by 75% in a month and 353% in a year.

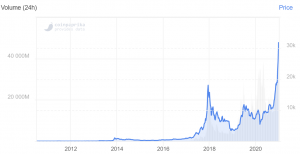

BTC price chart:

Meanwhile, as BTC is correcting its gains, ETH and altcoins are rallying. Ethereum skyrocketed by 25% in a day, trading at USD 1023 and increasing its weekly gains to 39%. The price jumped by 53% in a month and 574% in a year.

However, BTC trading volume hit almost USD 64bn (it was around USD 30bn on the average in the past month) in the past 24 hours, compared with ETH’s almost USD 28bn. BTC dominance, or the percentage of the total market capitalization, slipped below 70%.

Other coins from the top 10 club are up by 2%-18% today. Even the most troubled major coin, XRP, is up (2%) in a day, but it’s the only major cryptoasset that is down in a week (25%).

Also, today is the 12th anniversary of the first block in the Bitcoin blockchain mined, also known as the Genesis block.

As reported, BTC “will be on the road to USD 50,000 probably in the first quarter of 2021,” Antoni Trenchev, Managing Partner and Bo-founder of major crypto lender Nexo, told Bloomberg.

“When any asset climbs in price this fast for an extended period of time I become cautious, and I’d urge anyone trading BTC to not get caught up in the euphoria,” Nicholas Pelecanos, head of trading at NEM, told CNN. However, he predicts bitcoin could rise to USD 50,000 by Valentine’s Day. “I believe we are just at the beginning of what will be an immense bull market.”

“It’s very likely that the asset will eventually pass USD 100,000 per coin,” Sergey Nazarov, Co-founder of Chainlink (LINK) wrote in an email to Reuters. “People have been steadily losing faith in their government currencies for years, and the monetary policies resulting from the economic impact of the coronavirus have only accelerated this decline.”

Also as reported, only BTC 4.2m (22%) are currently in constant circulation and available for buying and selling. However, it also estimated that, in 2021, the aggregated BTC exchange balance will rise as more holders seek to realize profits or to trade other cryptocurrencies.

Follow our socials Whatsapp, Facebook, Instagram, Twitter, and Google News.

![18 local airlines share N4b aviation intervention fund 7 [FILES] The Guardian learned that the grant was thrown open to all operators with valid air operating certificates (AOCs) and distributed according to the size of the carriers.](https://www.afriupdate.com/wp-content/uploads/2021/01/Foreign-airlines-1062x598-1-75x75.jpg)