The digital asset markets are continuously evolving and innovating to accommodate different types of traders. One of the latest innovations in the crypto trading space is leveraged tokens.

In this article, you will be introduced to these tokens, how they work, and we discuss their benefits and drawbacks.

What Are Leveraged tokens?

A leveraged token is a financial derivative that enables you to gain exposure to a leveraged trading position in a digital asset without the complex aspects of managing a margin trade.

Leverage tokens are ERC20 tokens that represent a leverage long or short position in a cryptoasset. The main selling point of these new crypto derivative tokens is that they enable you to take leveraged positions without having to deal with collateral, funding rates, margin management, and liquidation. Their relative simplicity is why they have garnered a lot of attention since their launch.

Leveraged tokens were first introduced by the crypto derivatives exchange FTX to provide a new way for traders to take leveraged positions on a wide range of digital assets. Since then, a number of other trading platforms, including Binance, have followed suit.

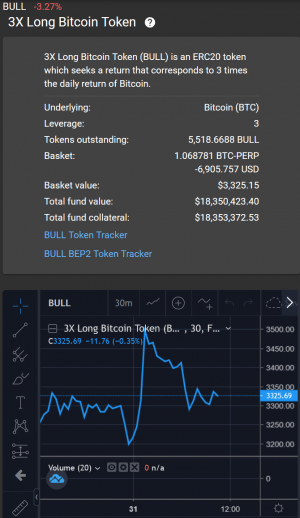

In the screenshot below, for example, you can see 3X Long Bitcoin Token – traded on FTX – that represents a three times leveraged long position on bitcoin (BTC) on a daily basis.

The value of these tokens goes up and down with the price of bitcoin but with a leverage of three times. So, if the price of bitcoin rallies by 5% within a few hours, you can expect to make 15% on your 3X Long Bitcoin Token if you close it out at that point.

To make leveraged tokens possible, FTX issues (and redeems) these tokens in the form of ERC20 tokens on the Ethereum (ETH) blockchain. Additionally, the exchange rebalances the tokens on a daily basis. This enables the value of the token to be in line with the value of the underlying digital asset.

The pros and cons of these tokens

As with all financial products, there are benefits and drawbacks. Leveraged tokens are no exception. Below, you will find a list of the most important pros and cons of leveraged tokens.

Pros

Leverage tokens enable anyone to take an intra-day leveraged position in a digital asset without the technicalities of a margin trade.

As these tokens exist on the Ethereum blockchain as ERC20 tokens you can transparently track them and hold them in a personal Ethereum wallet.

Cons

Trading Leveraged token is very risky. The value of your tokens can drop substantially if the market moves significantly.

These are new, experimental financial derivatives and glitches can happen. Therefore, it would be advisable not to risk too much on these new investment products.

Since they are rebalanced daily, these tokens are not meant for long-term holding. If you want to take a medium or long-term leveraged position, you would be better off going the traditional route of buying a cryptoasset using margin.

Not all leveraged tokens are equal. Some exchanges offer more transparency while others offer less.

Should you trade leveraged tokens?

Well, if you are an experienced margin trader who wants to bet on intraday price pumps or drops, you could use these tokens instead of taking “traditional” leveraged positions on a digital asset exchange or using Contract for Differences. They are simpler to use and trade, and provide a novel way to trade crypto.

READ ALSO: How To Earn Free Crypto With Mobile Cloud Mining

However, if you are not an experienced crypto trader, you are probably better off sticking to spot trading as the chance of losing money is much higher with leveraged tokens.

Moreover, given how new and experimental these tokens are, you may want to wait and see how this market evolves before putting too much capital at risk. As with all new technologies, things can go wrong and they usually do at the worst possible time. So, if you do decide to trade leveraged tokens, you may want to start small before taking on more risk.

Follow our socials Whatsapp, Facebook, Instagram, Twitter, and Google News.

![RMAFC: FG To Review Salaries Of Political Office Holders 6 [FILES] Buhari. Photo: TWITTER/NIGERIAGOV](https://www.afriupdate.com/wp-content/uploads/2021/04/Buhari-9-1062x598-1-75x75.jpg)