• We will end energy poverty, and losses, says Kyari

• Why NNPC may remain a loss-making company despite transitioning – Experts

• Redundant staff, political will, harsh environment clouds Buhari, stakeholders’ expectations

• Transitioning a mere name change, says Famutimi • Former LCCI boss insists a new Aramco may emerge

• Adesanya: Subsidy, liabilities, and frontier exploration may impact cash flow

• OPS backs hike as oil marketers comply with NNPC directive, raise petrol price to N179/litre

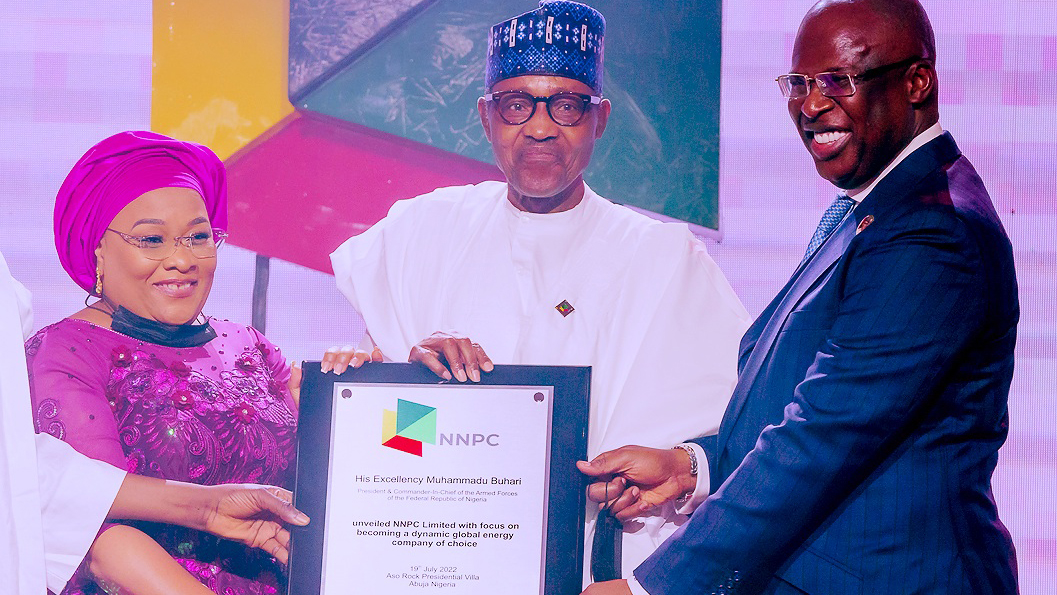

After 45 years of its creation and perpetual loss-making, President Muhammadu Buhari, yesterday, unveiled a new Nigerian National Petroleum Company (NNPC) Limited, a development that is generating dissent among stakeholders.

Though expectations are high that Nigerians would now enjoy dividends from their oil resources after years of wasteful spending and management, some stakeholders told The Guardian, yesterday, that the new NNPC Limited may be nothing beyond a name change, while others envisage a new national oil company that would compete with the likes of Saudi Aramco, now adjudged the most valuable in the world with market valuation of $2.43 trillion.

Going by provisions of the Petroleum Industry Act (PIA), NNPC had on July 1, 2022, legally transformed into a company that would be regulated under the Companies and Allied Matters Act, CAMA.

At the moment, stakeholders are totally unsure about how the new company would deal with legacy issues, including redundant staff, religious and ethnic considerations, government and political interference, extant liability, compulsory commitment to frontier exploration, mounting pressure over energy transition, derelict refineries and over 90 per cent loss-making subsidiaries.

Across the world, national oil companies are making profits but NNPC has not declared a profit in over 45 years.

In 2020, Sinopec, also known as China Petroleum and Chemical Corp, raked in $323 billion, Saudi Aramco made $230 billion at a time when NNPC is making as much as N6 trillion loss to Premium Motor Spirit (PMS) subsidy instead of locally refining the product.

Unveiling the new NNPC, Buhari still dwelt on the role of the company as the last resort, affirming that the company is mandated by law to ensure that Nigeria’s national energy security is guaranteed.

He expressed optimism that NNPC Limited will sustainably deliver value to its over 200 million shareholders and the global energy community; operate without relying on government funding and be free from institutional regulations such as the Treasury Single Account (TSA).

‘’Our country places a high premium in creating the right atmosphere that supports investment and growth to boost our economy and continue to play an important role in sustaining global energy requirements.

‘’We are transforming our petroleum industry to strengthen its capacity and market relevance for the present and future global energy priorities,” he said.

According to the President, NNPC will conduct itself under the best international business practice in transparency, governance and commercial viability.

Minister of State for Petroleum Resources, Timipre Sylva, said the signing of the PIA provided international and local oil firms adequate protection for their investments, adding that the nation’s petroleum industry is no longer rudderless.

‘’From the onset of this administration, Mr President never concealed his desire to create a more conducive environment for the growth of the oil and gas sector, and addressing legitimate grievances of communities most impacted by extractive industries.

‘’We are setting all these woes behind us, and a clear path for the survival and growth of our petroleum industry is now before us,’’ he said.

The Group Chief Executive Officer of NNPC Limited, Mele Kyari, announced that the company had adopted a strategic initiative to achieve the mandate of energy security for the country by rolling out a comprehensive expansion plan to grow its fuel retail presence from 547 to over 1,500 outlets within the next six months.

He assured stakeholders and the global energy community that the new company was endowed with the ‘’best human resources one can find anywhere in the industry.

‘’NNPC Limited is positioned to lead Africa’s gradual transition to new energy by deepening natural gas production to create low carbon activities and positively change the story of energy poverty at home and around the world,’’ he said.

FORMER President at Nigerian-American Chamber of Commerce (NACC) and business mogul, who heads Tricontinental Group, Olabintan Famutimi, however, insisted that there is nothing to show that the country is ready to get a national oil company that would abide by global best practices.

According to him, the current transition by NNPC is merely a change of nomenclature. He noted that while most of the profiting national oil firms are run without interference, political overbearing would play out at NNPC.

“Government will still be the one to dictate a lot of things. They are the ones that won’t make the refineries work. They will still dictate who gets a licence and gets access to foreign exchange. I don’t see what has changed.

“Aramco has privatised its operation and is the most valuable corporation in the world. They have the most digitalised operation in the world. But we are retrogressing at a time when we should be making money. We are still subsidising oil. The system is designed to allow a few make an unimaginable amount of money from the industry and not allow commercial sense to take over,” Olabintan said.

Energy lawyer, Madaki Ameh, said: “I am not optimistic about the unveiling of NNPC as a limited liability company under CAMA 2020 because it is akin to putting new wine in old wineskins.”

Madaki said while the staff remain the same as well as their operational modus, the company, as a consistent loss making organization, may not change.

“I don’t see how the change will catapult NNPC Ltd into a profitable business. It is early days yet, but the optimism has to be a cautious one, so that Nigerians will not be disappointed, again,” he noted.

Finance analyst, Kalu Aja, noted that with NNPC still making PMS subsidy payments, the prevailing transition “is more of audio literally.”

Former Director-General of the Lagos Chamber of Commerce and Industry (LCCI), Dr. Muda Yusuf, insisted that for the new NNPC to become like Aramco in the coming years, political will and a total operational shift would be needed.

According to him, the redundant staff and entities must give way while the company must make efforts to be listed internationally, including offering shares to Nigerians.

Yusuf said: “I am expecting a very profitable company. We also want to see the most valuable company. I am also hoping for it to be listed in the international stock exchanges around the world.

“But what is important in all of this is that the business model must be right. We need a business model that moves beyond political interference, interference from bureaucracy and a model that will dilute ownership and ensure that the management of the company is in the hand of professionals.”

Former President of the Nigerian Association of Petroleum Explorationists (NAPE), Abiodun Adesanya, said dealing with issues around subsidy, refineries, liabilities and frontier exploration have critical roles to play on the company’s cash flow and profitability.

According to him, the management of the company and the level of autonomy enjoyed by the company will mar or make projected expectations.

“We need to now decide whether to sell the refineries. Any entity that is a drain to the system now must be cut off. That will have a significant impact on their balance sheet. They have some debt, litigation and staff issues. They have to let go some staff that are not productive anymore.

“We are aware that there are liabilities and the liabilities are quite significant. They are still subsidising petrol and the lawful frontier issues must be addressed,” he noted, adding that the frontier exploration and cost already captured in PIA must be looked at.

Executive Director, Civil Society Legislative Advocacy Centre (CISLAC), Auwal Rafsanjani, noted that transparency and accountability issues would impact the new company, insisting that NNPC is still not transparent.

Recall that on August 16, 2021, the President signed the Petroleum Industry Bill (PIB) 2021 into law, providing a legal, governance, regulatory and fiscal framework for the petroleum industry, development of host communities and related matters.

Rafsanjani said months after the PIA implementation, a fuel hike was brought back into the system, adding that steps made towards the implementation of the PIA have been dismal.

Rafsanjani said there was a need for a political will for consistent implementation of the provisions of the law and continuous engagement and consultations with all stakeholders for their unflinching support necessary for the success of the law.

Executive Secretary, Nigeria Extractive Industries Transparency Initiative (NEITI), Dr. Orji Ogbonnaya Orji, while applauding the transitioning of NNPC, said: “Nigeria needs a business-oriented NNPC to deliver the country’s energy needs, energy transition, energy security, diversification of its economy and the building of a sustainable energy future for the country.”

He further explained that the immediate challenge that the new NNPC needs to tackle is to free Nigeria from fuel importation.

He commended the new team at NNPC and the present administration for the political will to get this reform done, expressing confidence that the company will live up to its obligations as a supporting firm of the global EITI.

He also reiterated his call on the Federal Government to replicate the same feat for the solid minerals sector.

MEANWHILE, in compliance with NNPC Limited directive, oil marketers have increased the pump price of petrol to N179 per litre, from N165 per litre. In its directive to oil marketers, on Monday, the company had put the new pump price and the ex-depot price at N179 per litre and N167 per litre respectively, beginning yesterday.

Checks by The Guardian showed that oil marketers have already adjusted their pumps to reflect the directive in Lagos, Abuja and other parts of the country.

Following the hike, members of the Organised Private Sector (OPS) have advised Nigerians to accept the new price regime, blaming it on systemic failure by the Federal Government.

The private sector group, representing the voices of chambers of commerce, the business community, private investors and business owners, said there was no way pump price of fuel could be sold at the filling stations across the country again at N165 in addition to the government having to pay N4 trillion as fuel subsidy to oil marketers.

In addition, they emphasised that the new price hike in energy cost was now bridging delivery disputes between manufacturing companies and logistics companies in manufactured goods deliveries nationwide with Nigerians expected to pay more in the cost price of commodity goods.

A former President of the Lagos Chamber of Commerce and Industry (LCCI), Mr Babatunde Ruwase, pointed out that market fundamentals were already in place and that it was impossible for oil marketers to bring the product to their stations at N170 ex-depot price and sell at N165 per litre.

Follow our socials Whatsapp, Facebook, Instagram, Twitter, and Google News.

![Buhari says leading Nigeria was ‘one of hardest challenges in life’ 3 [FILES] Nigeria President Muhammadu Buhari](https://www.afriupdate.com/wp-content/uploads/2023/01/Buhari-13-1062x598-1-120x86.jpg)